HSBC Middle East in collaboration with Riz Khan produced a Mini-Web Series highlighting the trials and tribulations of Business Leaders in the Middle East. Here is a look at what to expect.

While their western and, in some cases, even eastern counter parts are highly lauded, even regarded as celebrities, Middle Eastern business leaders do not receive the same accolades. HSBC decided to honor these leaders by producing a web mini-series called the ‘CEO’s Outlook’ presented by Riz Khan. Khan is a well distinguished Television presenter most well known for his self titled show on Al Jazeera TV, in which he interviewed Television, Political and Business personalities. This Mini-series follows the similar interview pattern with a spotlight on the CEOs based in the Middle East.

Preview of the Mini-Series (Source: HSBC Global Connections via YouTube)

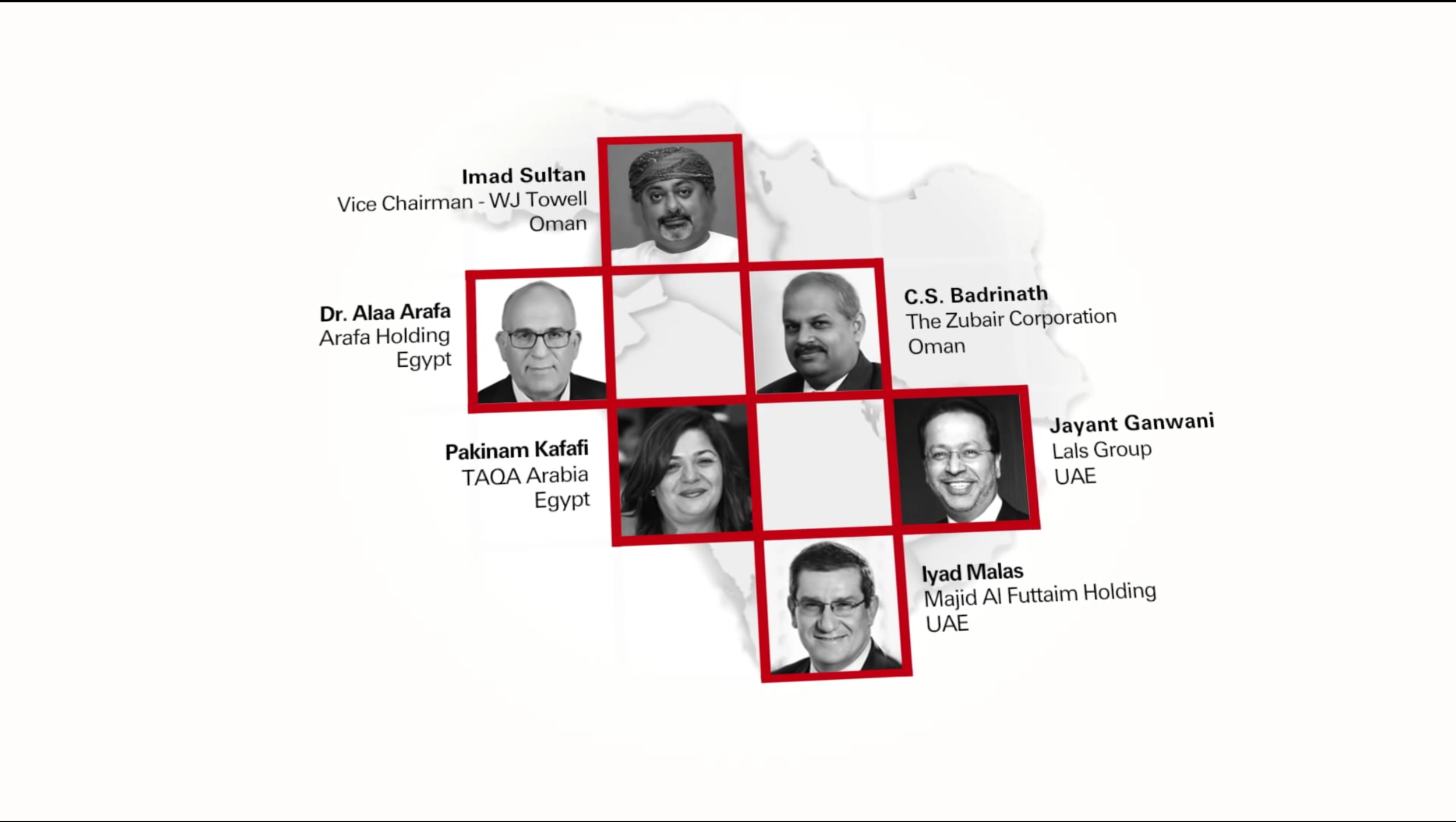

The series features notable business leaders including:

- Imad Sultan, Vice Chairman of the WJ Towell Group who features in the episode titled “Leadership: success, family business & future – WJ Towell”

- CS Badrinath, CEO of the Zubair Corporation who features in the episode titled “Money barriers – Zubair”

- Iyad Malas, CEO of Majid Al Futtaim who features in the episode titled “Managing change – Majid Al Futtaim”

- Jayant Ganwani, CEO of Lals Group who features in the episode titled “Growth & getting to market – Lals Group”

- Pakinam Kafafi, CEO of TAQA Arabia who features in the episode titled “The right advantage – TAQA”

- Dr Alaa Arafa, CEO of Arafa Holding who features in the episode titled “Taking the leap – Arafa”

The topics Riz Khan discussed with these CEOS range from successes and the future to family involvement and bipartisan participation. Each episode provides an insightful look into the operations and intricacies of being a CEO in their unique environment.

Imad Sultan talks about how family businesses best manage the process of bringing in the next generation based on personal firsthand experience. He discusses the unique challenges of running a fifth generation family business, including the need to restructure, separating ownership from management and priming the next generation to continue the legacy.

The CEOs featured on the show (Source: HSBC Global Connections vs YouTube)

CS Badrinath discusses the challenges of accessing and managing capital in the context of a growing business. He considers the vital importance of access to capital – ‘the bloodstream of any organisation’. He goes into detail about how a company faces a delicate balance of allocating capital to projects while, at the same time, managing the risks.

For Iyad Malas, understanding the consumer is the key to success in any new market. Moving into a new market demands flexibility and the ability to change your approach as he explains. It is a dynamic process as the company continues to take on new information when it is established in the market and continually adapts its offering to meet consumer demand.

Jayant Ganwani, discusses how his company has achieved its regional expansion and managed local differences. He highlighs the importance of in-depth market research even for neighbouring countries that may be considered familiar.

Pakinam Kafafi, CEO of TAQA Arabia, talks about the challenges and excitement of expanding into new markets. She considers helping a local company expand globally as an exciting process. However, expansion can be challenging and requires experienced employees, know-how and persistence.

Moving into new markets can be like leaping off a cliff. The right information, support and leadership is vital, according Dr Alaa Arafa, Riz Khan and Arafa go into more detail on the challenges his company faced while entering new markets.

With all these insights, the various challenges local companies faced in an open and international market were highlighted. Ria Khan was an engaging host and kept the conversation going forward. This is definitely a must watch for a business insider.

Full Disclaimer: HSBC did not intend to constitute any advice or an offer with this Web series. Any forecasts or projections are indicative only. HSBC or any of its affiliates accepts no liability, whether express or implied, arising out of or incidental to contents forming part of the Web Series.